www tax ny gov enhanced star

The Enhanced STAR exemption amount is 74900 and the school tax rate is 21123456 per thousand. Eligibility is based on the combined incomes of all the owners and any owners spouse who resides at the property.

You can register for the state tax credit at wwwtaxnygovstar or by calling 518 457-2036.

. To be eligible for the Enhanced STAR exemption you must meet all of the following conditions. To be eligible for Enhanced STAR you must have earned no more than 86000 in the 2016 tax year. You owned your property and received STAR in 2015-16 but later lost the benefit and would like to apply to have it restored.

More information is available at wwwtaxnygovstar or by calling 518 457-2036. See the STAR resource center to learn more. The STAR Program provides school district property tax relief to all residential property owners and enhanced property tax relief to income eligible senior citizens age 65 or older.

The Enhanced STAR savings amount for this property is 1000. The following security code is necessary to prevent unauthorized use of this web site. Tax ny gov enhanced star Saturday June 4 2022.

You own your home and it is your primary residence. Follow the step-by-step instructions below to eSign your ny application enhanced star. Basic STAR is for homeowners whose total household income is 500000 or less.

Register with the NYS Department Taxation Finance at 518-457-2036 or wwwtaxnygovstar. You should register for the STAR credit if you are. Create your eSignature and click Ok.

You can receive the STAR credit if you own your home and its your primary residence and the combined income of the owners and the owners spouses is 500000 or less. If you are a new homeowner or first-time STAR applicant you may be eligible for the STAR credit. Enhanced STAR is for homeowners 65 and older whose total household income for all owners and spouses who live with them is 92000 or less.

If you are using a screen reading program select listen to have the number announced. Department of Taxation and Finance Enhanced STAR Income Verification Program If you are receiving this message you have either attempted to use a bookmark without logging into your account or you have timed out. Register with the NYS Tax Department.

WENY The New York State Department of Taxation and Finance is reminding property owners 65-years-old and older who are applying or reapplying to receive the Enhanced STAR exemption in 2019 that they now must enroll in the Income Verification Program IVP. The benefit is estimated to be a 650 tax reduction. If you are a new homeowner or first-time STAR applicant you may be eligible for the STAR credit.

Qualifying property owners can reduce their property tax burden by taking full advantage of the many property tax exemptions that are offered by Nassau County. Ad Download fax print or fill online NY RP-425 more subscribe now. Enhanced STAR is available to owners of condos houses and co-ops who are 65 with.

The Enhances STAR Exemption will provide an average school property tax reduction of at least 45 annually for seniors living in median-priced homes. ALBANY NY 12227-0801 The Office of Real Property Tax Services ORPTS will take the following steps. The following security code is necessary to prevent unauthorized use of this web site.

The New York State Department of Taxation and Finance today reminded seniors that for most localities the deadline to apply for greater property tax savings through the Enhanced STAR property tax exemption is March 1. The STAR program can save homeowners hundreds of dollars each year. If youre eligible for the STAR credit youll receive a check for the amount of your STAR savings.

Apply and are eligible for the Enhanced STAR exemption. The State will automatically upgrade your Basic STAR Credit to the Enhanced STAR Credit. If you are registered for the STAR credit the Tax Department will send you a STAR check in the mail each year.

Your total combined income cannot exceed 92000. If you are using a screen reading program select listen to have the number announced. 01 2022 800 am.

You can use the check to pay your school taxes. The STAR exemption program is closed to new applicants. January 5 2021.

02 2022 640 am. You will be 65 or older by December 31 of the year of exemption. If you are interested in filing for the Basic and Enhanced STAR programs please contact the Nassau County Department of Assessment at 516 571-1500.

Decide on what kind of eSignature to create. You may apply for the Basic STAR or Enhanced STAR tax exemption with the NYC Department of Finance if. Qualified recipients of the Enhanced STAR exemption save approximately 650 in NYC property taxes each year.

Primary-residence owners that meet additional requirements are eligible to receive the Enhanced STAR exemption. Select the document you want to sign and click Upload. March 1 is the deadline to apply for property.

If you are approved for E-STAR the New York State Department of Taxation and Finance will use the Social Security numbers you provide on this form to automatically verify your income eligibility in subsequent years. Review the form and documentation provided by the property owner email the assessor and county director requesting a response within 5 days if they have information that would result in denial of the good cause request. A typed drawn or uploaded signature.

Ad Download Or Email NY RP-425 More Fillable Forms Register and Subscribe Now. To be eligible for the 2022 Enhanced STAR property tax exemption seniors must. 74900 21123456 1000 158215.

Those already enrolled in the IVP dont need to take any action to. There are three variants. Enter the security code displayed below and then select Continue.

In this example 1000 is the lowest of the three values from Steps 1 2 and 3. Today is the last day to apply for STAR other property tax exemptions in NY Updated. PLEASE BE SURE THAT YOU FILE BOTHTHE RP-425E.

You only need to register once and the Tax Department will send you a STAR credit check each year as long as youre eligible. Enhanced STAR Exemption Application Deadline for Seniors is March 1st Homeowners who receive the STAR Credit check from the State instead of the STAR Exemption on their tax bill do not need to apply for the Enhanced STAR Credit upon turning 65. Your income must be 92000 or less.

For jointly owned property only one spouse or sibling must be at least 65 by that date. Enter the security code displayed below and then select Continue. To be eligible all property owners must be 65 years of age or older with incomes that do not exceed 86300 a year as amended annually according to a cost-of-living adjustment COLA used by the Social Security Administration.

If you did not own this property and receive STAR in tax year 2015-16 you cannot apply for E-STAR with the Department of Finance. STAR Check Delivery Schedule. The benefit is estimated to be a 293 tax reduction.

Even if you exceed this limit you are most likely still eligible for Basic STAR. Enhanced STAR is one of several property tax exemption programs which are available to qualifying homeowners in NYC. This form is primarily for use by property owners with Basic STAR exemptions who wish to apply and are eligible for the Enhanced STAR exemption.

The School Tax Relief Star Program Faq Ny State Senate

New Two Star Property Tax Relief Bill By Tedisco Lawler Seeks End To New York S Tax Eternity Ny State Senate

Deadline For Seniors Enhanced Star Exemption In Suffolk Towns Is March 1 Newsday

Rebate Checks Gone In Nys Star Checks Continue For Now Yonkers Times

Application Deadline Nears For Enhanced Star Property Tax Exemption Westside News Inc

:quality(70):focal(1446x1205:1456x1215)/cloudfront-us-east-1.images.arcpublishing.com/tronc/CEH7XCAU3RGZRIFZ3QD7EA46X4.jpg)

Check Yourself Gov Hochul Reminds Voters Who Provided Them A Rebate New York Daily News

Register For The School Tax Relief Star Credit By July 1st Greene Government

Tax Rebate Checks Land In Mailboxes As Elections Approach Local News Niagara Gazette Com

When Will Ny Homeowners Get New Star Rebate Checks Syracuse Com

Governor Hochul Mails Out Rebate Checks Early Suozzi Cries Foul Yonkers Times

If You Recently Bought Your Home Or Never Applied For The Star Benefit On Your Current Home Register You May Save H How To Apply Star Application Filing Taxes

If You Recently Bought Your Home Or Never Applied For The Star Benefit On Your Current Home Register You May Save H How To Apply Star Application Filing Taxes

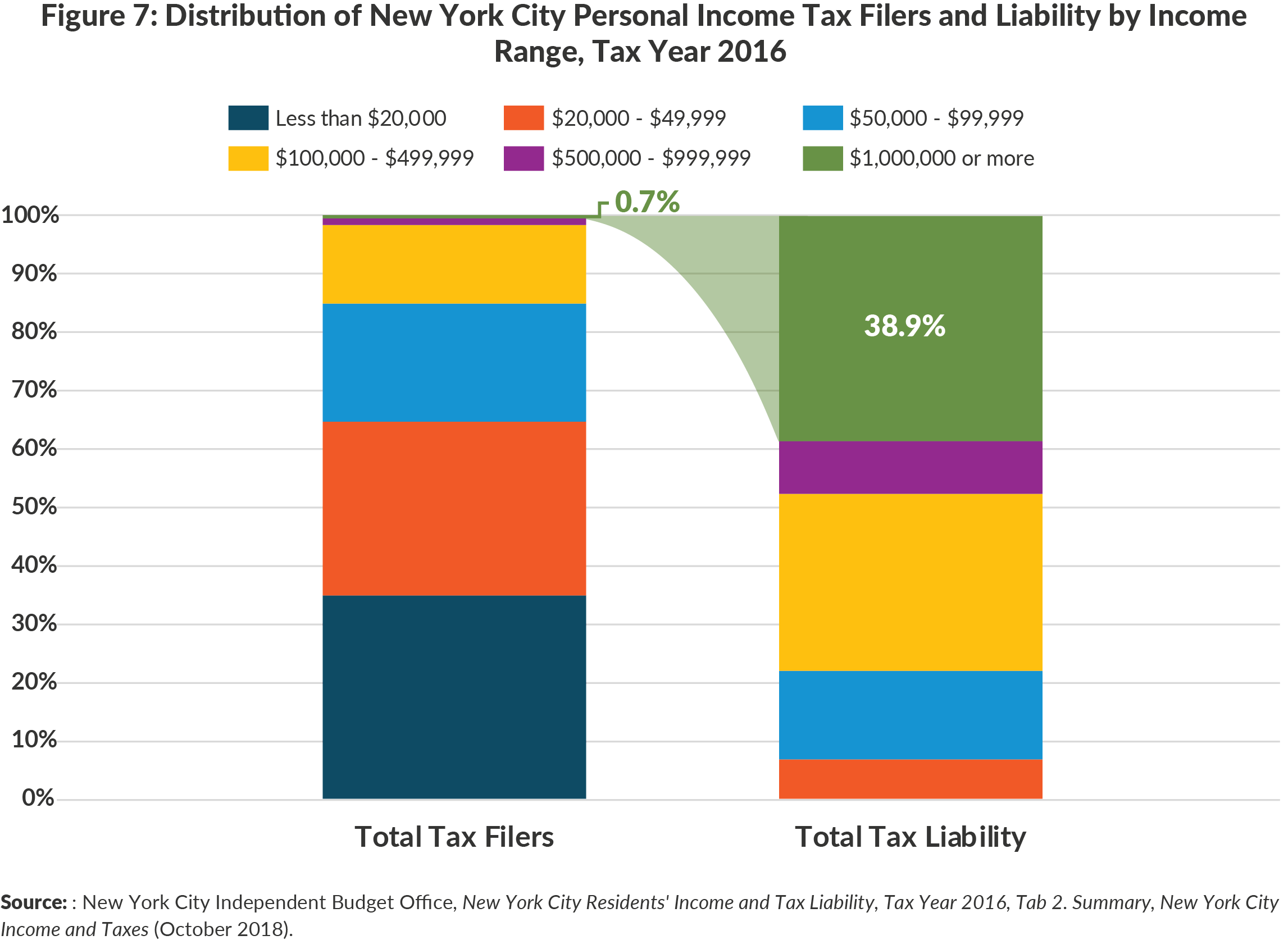

Personal Income Tax Revenues In New York State And City Cbcny