best buy 401k withdrawal

I know BBY setup some special provisions for financial hardship and such. Consider these retirement account withdrawal strategies.

Can A First Time Homebuyer Use Their 401 K To Buy A House

Withdraw funds in years.

:max_bytes(150000):strip_icc()/what-to-know-before-taking-a-401-k-hardship-withdrawal-2388214-v2-211c0d162ae64a95bbe3813f1f9243ad.png)

. People do this for many. Best buy 401k withdrawal 401k Withdrawal Rules For Home Purchases 2021. Under 59 ½.

Youll still need to collect the tax forms every year to give you your tax preparer but you wont be putting any money into it. Nothing will happen to it if you dont do anything to it. Most 401 k plans allow for penalty-free withdrawals starting at age 55.

Birth or adoption of a child. 2016 employees reported this benefit. Enter username and password to access your secure Voya Financial account for retirement insurance and investments.

Home 401k best buy withdrawal. Removing funds from your 401 k before you retire because of an immediate and heavy financial need is called a hardship withdrawal. Did you just have to.

However a 401 k withdrawal for a home purchase is generally not the best move given there. Best Buy 401K Plan. Available to US-based employees Change location.

Annuities are the only retirement plan that guarantees withdrawals for the rest of your life including after the account 401 k traditional IRA Roth IRA runs out of money. In general if allowed to make a withdrawal you will pay a 10 penalty and taxes. Take required minimum distributions to avoid penalties.

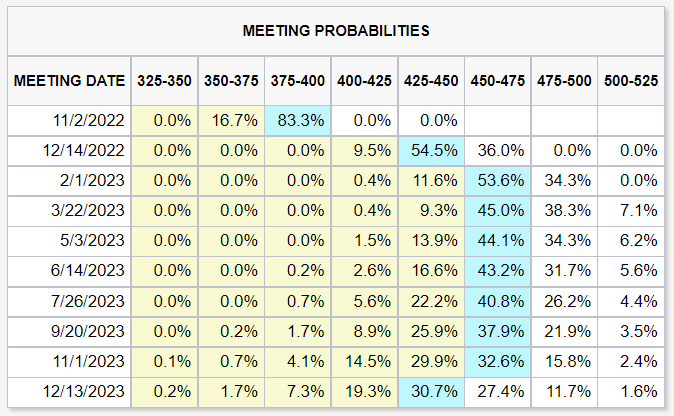

Best buy 401k withdrawal 401k Withdrawal Rules For Home Purchases 2021. I need emergency funds. A 401K has the following general rules based on your age at the time of the withdrawal.

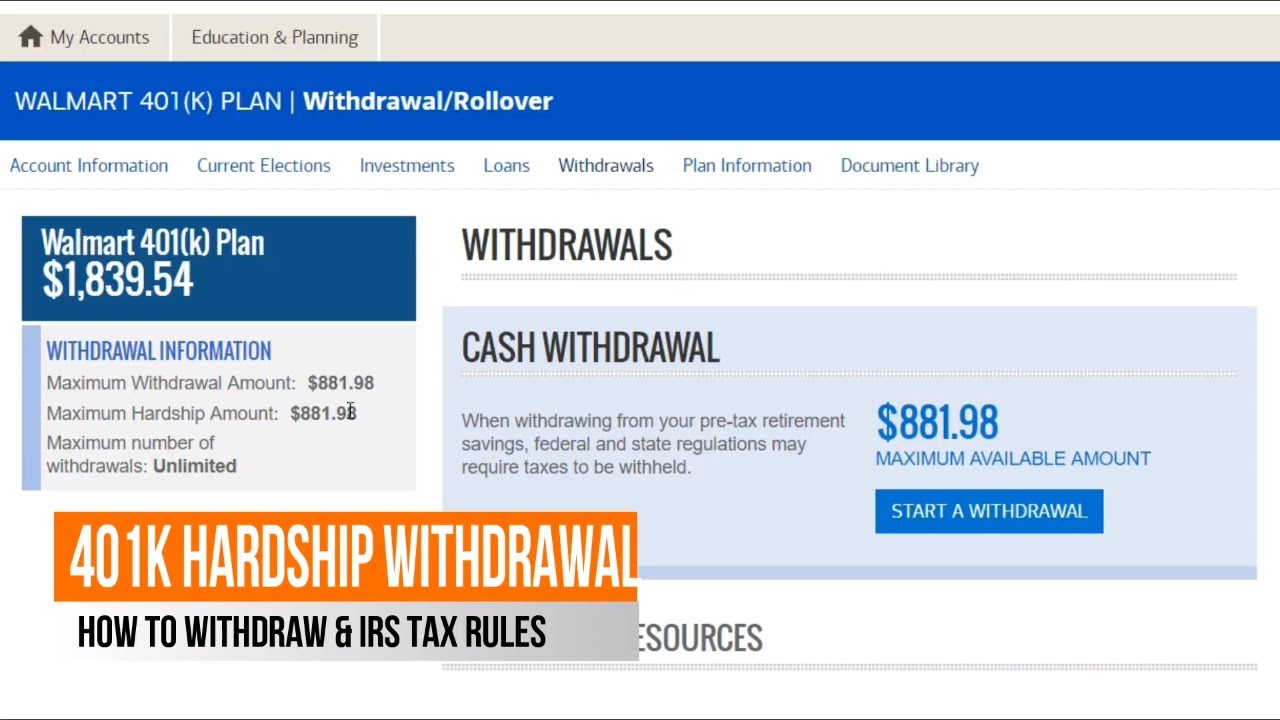

Rachel Hartman April 7 2021. Under the SECURE Act employees can withdraw up to 5000 from a retirement plan to cover the birth or adoption of a child penalty-free. Walmart 401k Hardship Withdrawal With Merrill Lynch Irs Tax Rules Crd.

Best buy 401k withdrawal Monday July 11 2022 Edit. You must have left your job no earlier than the. Removing funds from your 401 k before you retire because of an immediate and heavy.

Two-thirds of large 401k plans allow retired. Just seeing if anyone has pulled from their 401K during the pandemic. Whether you can take regular withdrawals from your 401k plan when you retire depends on the rules for your employers plan.

Withdrawing Funds Between Ages 55 and 59 12.

401 K Loans Vs Hardship Withdrawals Smartasset

Cashing Out A 401 K Due To Covid 19 Consider These Things First Nerdwallet

Should You Use A 401 K When Buying A House Mybanktracker

Retirement 3 Legal Ways To Shield Your Money From The Irs

Taxes On 401k Distribution H R Block

401 K Early Withdrawal Vs 401 K Loan Which Is Better Cnn Underscored

Can I Use My 401k To Buy A House

Using The Rule Of 55 To Take Early 401 K Withdrawals Smartasset

401 K Early Withdrawal Guide Forbes Advisor

Tapping Your 401 K Is Now The Right Time To Do It

Should I Cash Out My 401k To Pay Off Debt

The Rules Of A 401 K Hardship Withdrawal

How To Use A 401 K For A Home Down Payment Moneygeek Com

Should 401 K Withdrawals Be Easier Wsj

3 Things To Know About 401 K Distributions The Motley Fool

5 Retirement Withdrawal Strategies The Motley Fool

What Happens When You Make An Early 401 K Withdrawal Pai Com

Walmart 401k Hardship Withdrawal With Merrill Lynch Irs Tax Rules Crd Distributions April 20 Youtube