michigan sales tax exemption nonprofit

A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption. 501c3 organizations are automatically exempt from sales tax on purchases.

Amazon Certificates Required State For Exemption Tax Refund User Guide Manuals

Michigan income tax credit.

. Michigan Sales and Use Tax Contractor Eligibility Statement. Application for Sales Tax Exemption and Form DR-0716. Sales and Use Tax Exemption for Transformational Brownfield Plans.

501c3 Tax Exemption is Key. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on. Any questions please contact the Michigan Department of Treasury Sales Use and Withholding Tax office 517-636-6925.

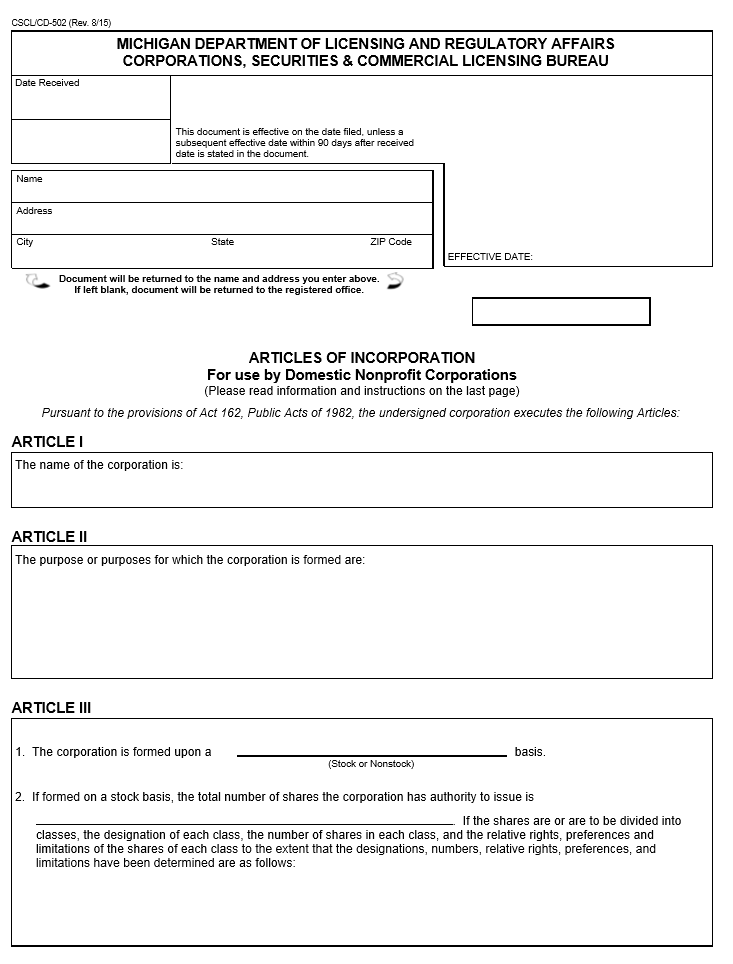

When completing a sales tax exemption certificate a nonprofit should be certain to complete the form in full and avoid an simple mistakes that may delay processing. To Obtain Michigan Sales and Use Tax Exemptions. Effective March 28 2013 certain charitable organization in the state of Michigan will be eligible for a sales tax.

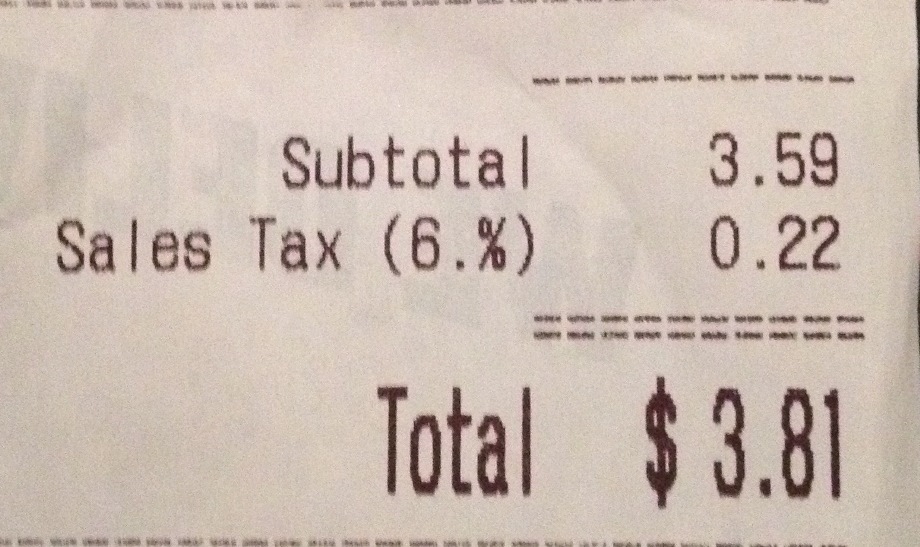

There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to your vendors making a claim for exemption from sales or use tax. The state sales tax rate is 6. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

All fields must be. CityLocalCounty Sales Tax - Michigan has no city local or county sales tax. 501c 3 organizations are automatically exempt from the Business Taxes.

Sales tax exemptions Michigan. Michigan Sales and Use Tax Certificate of Exemption. Michigan Nonprofits and Sales Tax Exemptions.

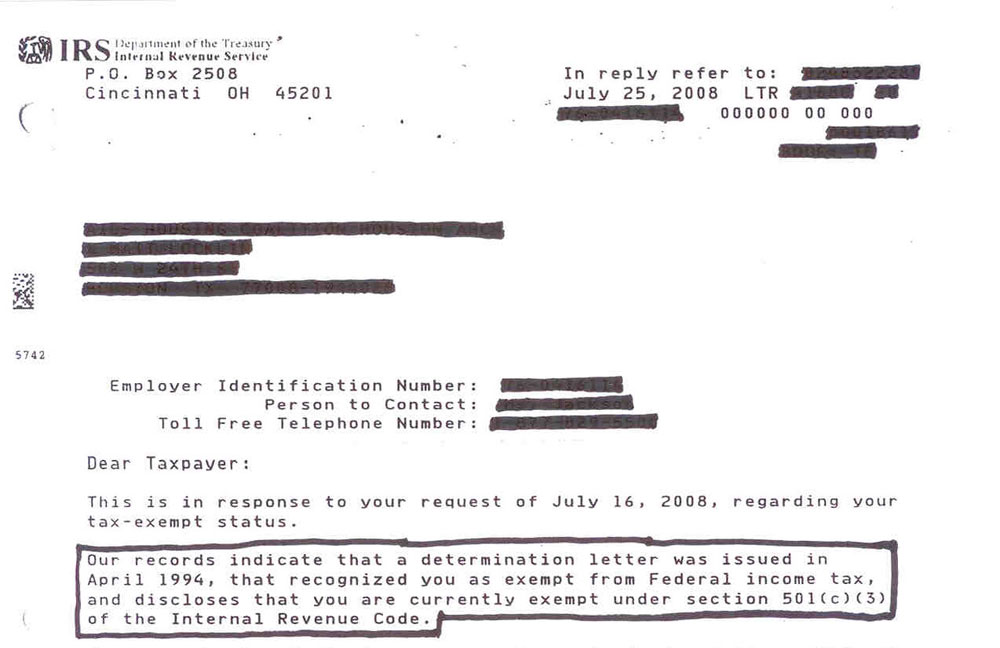

In order to claim exemption the nonprofit organization must provide the seller with both. RAB 2016-18 Sales and Use Tax in the Construction Industry. Nonprofit Internal Revenue Code Section 501c3 and 501c4 Exempt Organizations Attach copy of IRS letter ruling.

501c3 organization religious charitable scientific or education organization Customer involved in agricultural production. Nonprofit Organizations with an Exempt letter from the State of. However if provided to the purchaser in electronic.

HOW TO OBTAIN MICHIGAN STATES SALES AND USE TAX EXEMPTION. While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. To claim this exemption with each.

Harbor Compliance can obtain Michigan sales tax exemption for your 501c3 nonprofit. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax. In the majority of states that have sales tax excluding Alaska Delaware Montana New Hampshire and Oregon the key to earning a sales tax exemption.

Most charitable nonprofits must also file with the Attorney Generals. Certain businesses are exempt from paying sales and use tax including. Sales Tax Return for Special Events.

Certain 501c3 and 501c4 organizations for property used in the operations of the organization. Statement of Non-Profit - Church Synagogue or Organization. Harbor Compliance can obtain Michigan sales tax exemption for your 501c3 nonprofit.

Or improved is a nonprofit hospital or nonprofit housing entity no tax is due. This page discusses various sales tax exemptions in Michigan. Form 3372 Michigan Sales and Use Tax Certificate of Exemption.

Nonprofits And Tax Exempt Organizations Dykema

Sales Taxes In The United States Wikipedia

Tax Exempt Form Michigan Fill Online Printable Fillable Blank Pdffiller

Reconsidering Charitable Tax Exemption A Modest Proposal For The Nonprofit 1000 Non Profit News Nonprofit Quarterly

Nonprofit Sales Tax Exemption Semantic Scholar

Michigan Certificate Of Tax Exemption From 3372 Fill Out Sign Online Dochub

Sales Tax Exemption Certificate Fill Out Sign Online Dochub

First Period Products Is Pet Food Next Here S What Else Michigan Lawmakers Want Exempt From Sales Taxes Mlive Com

Michigan Is In A Hurry To Cut Taxes Is A Pet Food Tax Exemption Next Bridge Michigan

Where Can My Nonprofit Get Discounts And Tax Exemptions Charitable Allies

American Legion Department Of Michigan Ppt Download

Nonprofit Regulation In Michigan Ballotpedia

Free Michigan Articles Of Incorporation For Use By A Nonprofit Corporation Form Cscl Cd 502

Sales Tax Update For Nonprofits

Michigan Sales Tax Complexities For Nonprofits Yeo And Yeo

Sales Tax Goes Live For Florida Michigan Tennessee Kansas And Missouri Runsignup Blog

Form 3520 Fillable Michigan Sales And Use Tax Contractor Eligibility Statement For Qualified Nonprofit Hospitals Nonprofit Housing Church Sanctuaries And Pollution Control Facilities Exemptions

If Sales Tax Is Passed Michigan Would Have The Second Highest In The U S Michigan Capitol Confidential